philadelphia property tax rate 2022

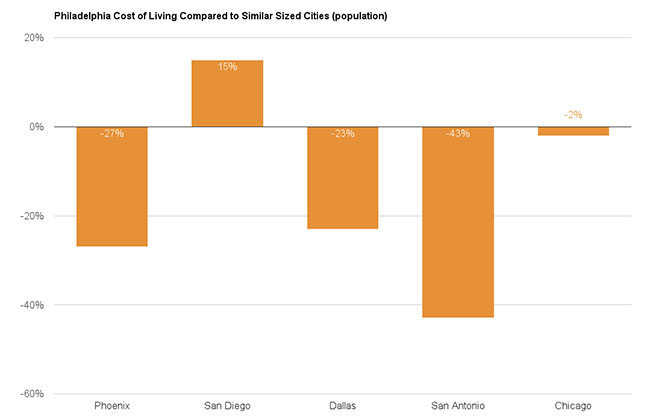

How Pennsylvanias Uniformity Clause Affects Property and Wage Taxes in Philadelphia 148-year-old language in the state constitution limits the citys options for reform. Pew found that residential properties account for 71 of Phillys property tax revenue in 2021 the highest share among comparable cities.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

After that date this tax will be.

. For the 2022 tax year the rates are. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. The average home sales price in Philadelphia went from more than 267000 in 2019 to nearly 311000 as of January according to the multiple listing service Bright MLS.

Ad Find County Online Property Taxes Info From 2022. Tax amount varies by county. The coronavirus pandemic disrupted the citys ability to conduct citywide property assessments for tax year 2022 leading officials to delay the reassessment for another year.

Philadelphia PA 19105. By contrast in 2020. But you must act fast as March 31 is.

Uncover Available Property Tax Data By Searching Any Address. Check your voter status apply for a mail-in ballot and more. The city received 154 of its general fund revenue from the tax in fiscal year 2021 and.

Continue to use our balance search website to pay your Real Estate Tax until October 2022. Philadelphias reliance on property tax revenue to fund city government is relatively low. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000.

06317 City 07681 School. Access the City of. Use the Property App to get information about a propertys ownership sales history value and physical characteristics.

1 How to Search Consult Print Download and Pay the Philadelphia Property Tax. In this tutorial we will explain step by step how to do this process. Buy sell or rent a property.

Then receipts are distributed to these taxing authorities according to a predetermined plan. The City of Philadelphia has announced that due to operational concerns caused by the COVID-19 pandemic it will forego a citywide reassessment of all property values for tax year 2022. Get help paying your utility bills.

1 be equal and uniform 2 be based on current market value 3 have one appraised value and 4 be deemed taxable unless specially exempted. Report a change to lot lines for your property taxes. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. You can also generate address listings near a. Our Installment program is also helping seniors and low-income families pay their bills in monthly installments.

Get home improvement help. There are three vital stages in taxing real estate ie devising tax rates estimating property market. Get help with deed or mortgage fraud.

The reassessment of Philadelphias 580000 properties is expected to generate 92 million in additional property revenue for the city with the value of the average residential. The new rate will apply to all applicable unearned income received in Tax Year 2022 January. As of July 1 2022 the rate for residents will be 379 previously 38398.

Taxation of properties must. 135 of home value. Get a property tax abatement.

By the numbers. Paying your Philly property tax online is always best. Get Real Estate Tax relief.

Philadelphia County collects on average 091 of a propertys. For the last decade property taxes have steadily contributed about 15 of Philadelphias general fund which finances most government functions. Request a circular-free property decal.

Searching Up-To-Date Property Records By City Just Got Easier.

What Is The Cost Of Living In Philadelphia Pa Movebuddha

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

What Is The Real Cost Of Living In Philadelphia 2022 Bungalow

Philly City Council Considers Relief For Property Taxes Whyy

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Birt And Npt Philly Business Taxes Explained Department Of Revenue City Of Philadelphia

Cost Of Living In Philadelphia Pa 2022 Movingwaldo

Philly Renters Should Probably Expect Rent Hikes To Account For New Tax Assessments

City Council Announces Poverty Action Plan With New Investments And Strategies To Lift 100 000 Philadelphians Out Of Poverty By 2024 Philadelphia City Council

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Philly City Council Considers Relief For Property Taxes Whyy

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Property Taxes On The Rise South Philly Review

For Homeowners Department Of Revenue City Of Philadelphia

Philly Budget Deal Expands Property Tax Relief And Cuts Business Taxes But Most Homeowners Will Still Have Tax Hikes

/cloudfront-us-east-1.images.arcpublishing.com/pmn/B46IT2TPMBGDFFQIHRLRPNECEI.jpg)

Philly Will Finally Start Mailing Property Assessment Notices